注:本文内容采编自讲座视频,如需了解完整内容,欢迎观看讲座回放视频。

编者按

Thank you Kepha and CIU for this opportunity to share. What I wanted to talk about today is about tech entrepreneurship in southeast Asia. And today I will cover five areas.

First, I will give everyone an overview of Southeast Asia. Second, I want to share a bit about the tech startups in Southeast Asia. No. 3, I want to talk a bit about the venture capital industry in Southeast Asia. No. 4, I will share a bit about my own personal learnings about what it takes to succeed, either in tech or in venture capital in Southeast Asia. And 5th, I wanted to share some views about how I see the tech entrepreneurship industry in the future in Southeast Asia.

1. Southeast Asia (SEA) Overview

First of all, an overview of Southeast Asia.

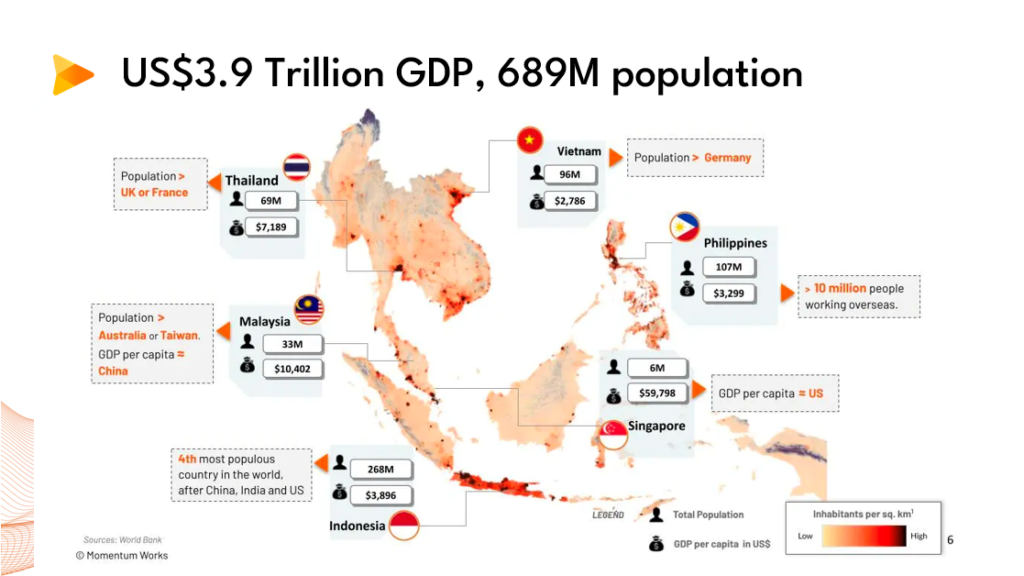

I’m not sure how familiar everyone is with Southeast Asia. How many countries are there, where it is, what is the population? This is a map of Southeast Asia. It shows the GDP and the population of Southeast Asia. So Southeast Asia’s GDP is about 3.9 trillion US dollars, and the population as of this year is about 689 million. And there are actually 11 countries in Southeast Asia, but this map only points out the six largest countries in Southeast Asia.

Let’s start with Indonesia at the bottom with the red and white flag. Indonesia is the country with the largest population in Southeast Asia, with 268 million people, and it’s actually the fourth largest country in the world.

The next biggest country is Philippines. Philippines has a population of a hundred and seven million people. And Philippines is known for a lot of its citizens working overseas, for example, as nurses. So they work in many overseas countries.

The next two bigger countries are Vietnam and Thailand. Vietnam has 96 million people, and Thailand has 69 million people.

And of course, the last two countries are Malaysia with 33 million and Singapore, which has a very small population of 6 million, but their GDP per capita of almost 60000, which is close to the US.

How are these, especially the GDP per capita, compared with China? I think this year China’s GDP per capita is about $12500. So based on that, you can see that China is actually more advanced in terms of the economy than many countries in Southeast Asia.

So what are the some of the drivers for the growth of Southeast Asia? The first thing is population growth, which is so important for any economy. The trend on the right shows the population growth for the next five years, and the countries in Southeast Asia are highlighted in blue.

Of course, many developed countries are actually shrinking in population, but many countries in Southeast Asia are still growing very fast. And in Southeast Asia, Philippines’ population is projected to grow the fastest.

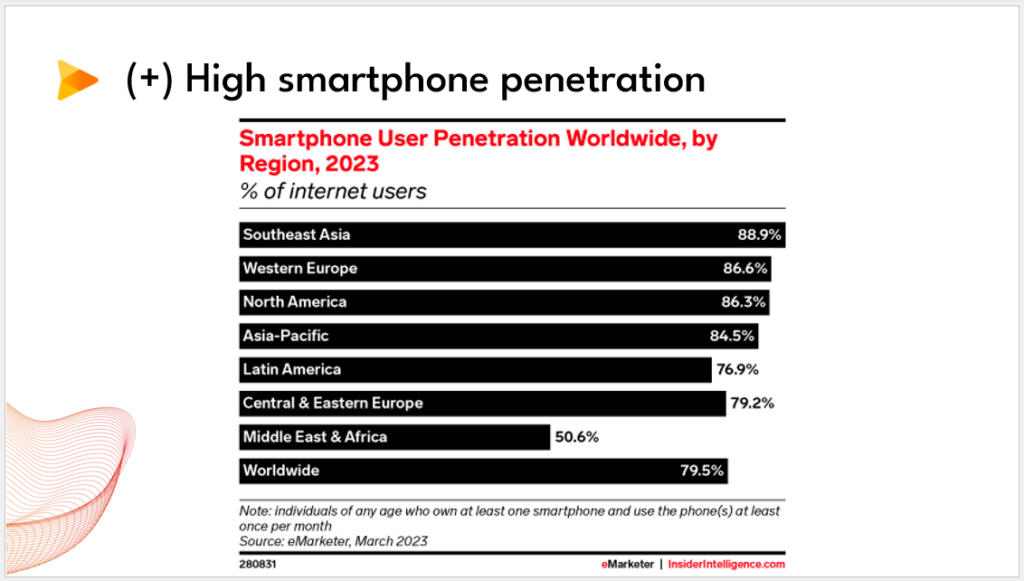

The other driver is smartphone penetration. And this report shows the smartphone user penetration of all regions across the world and shows that Southeast Asia is amongst the highest, with almost 90% smartphone penetration.

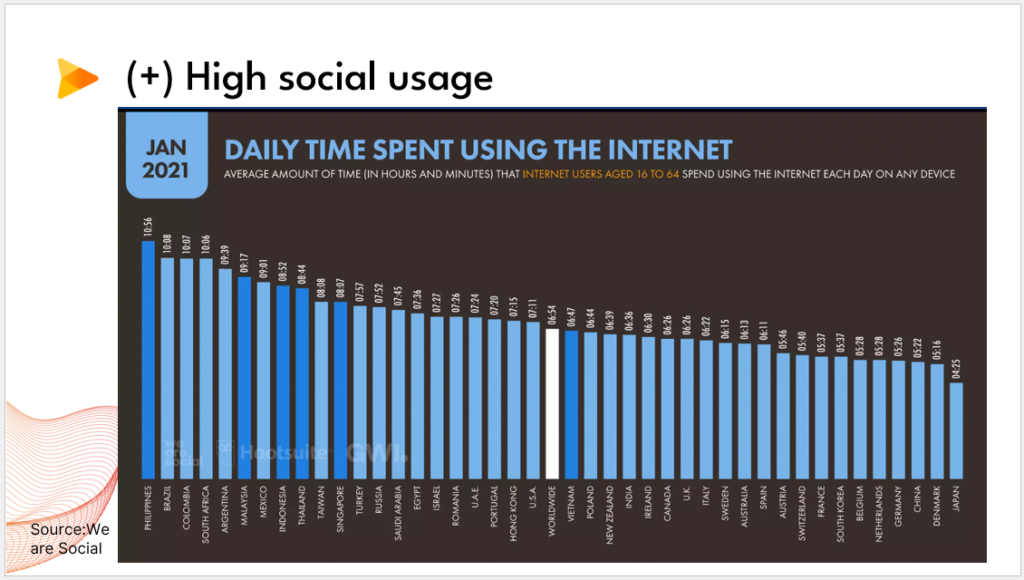

The other thing that’s important for the tech sector is, are the users spending time on the internet? And again, this chart shows, which is a global chart, and the countries in dark blue are the countries in Southeast Asia, and the world average is in white. The world average is about six hours and 54 minutes.

But of course, the highest on the left is Philippines, and the average Filipino spends about 11 hours a day using the internet. And of course, it’s followed by Malaysia, Indonesia, Thailand and Singapore, which are all above average. And Vietnam is actually just slightly below average, which is actually quite surprising.

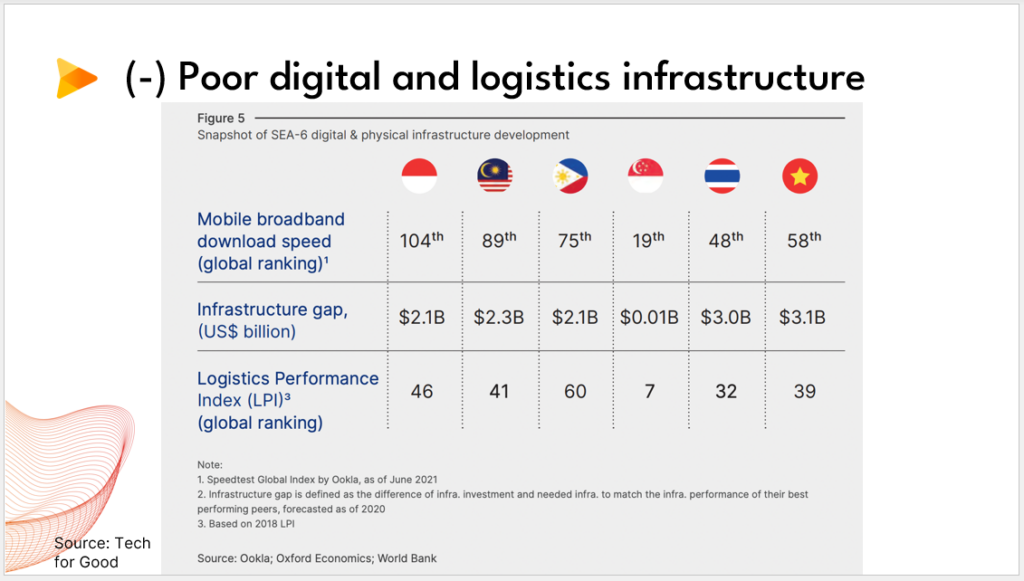

But one challenge for Southeast Asia is that the infrastructure, in terms of the digital infrastructure and the physical infrastructure, is still quite poor.

For example, in the first row, that is the mobile broadband speed. You can see the first country on the left, that’s Indonesia, and it’s ranked globally 104th. That means the average mobile broadband speed is actually very low.

The third row is Logistics Performance Index, and that basically shows you in terms of logistics, for example, trucking or shipping, that is still a big challenge in many countries in Southeast Asia. Again, if you look at Indonesia, No. 46 and Philippines No. 60. The reason for that is these two countries are comprised of many islands. Indonesia has 17000 islands, for example. So imagine if you’re e-commerce startup and you’re trying to sell your products to everyone in Indonesia, it will be very hard to send your products to many different islands.

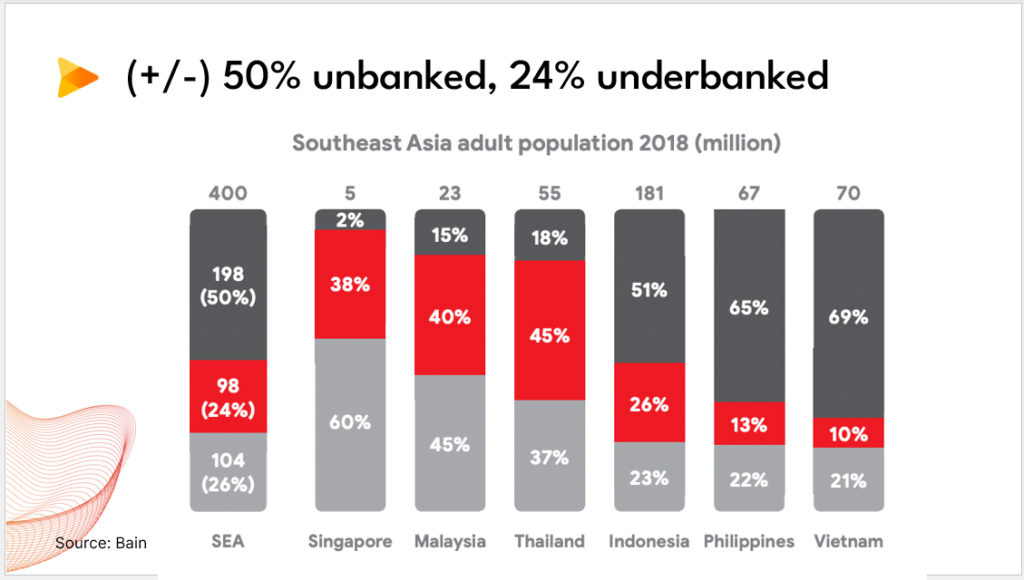

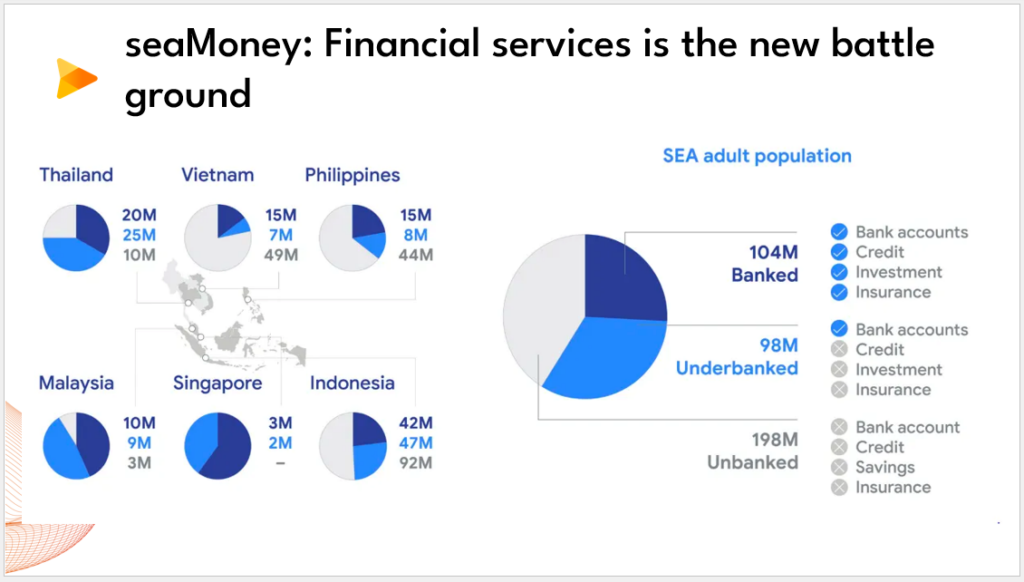

The other characteristic of Indonesia is the population that is unbanked or underbanked. Unbanked meaning they have no savings account. Underbanked meaning they do have a savings account, but it’s very hard for them to get a loan because the bank does not target the poorer segment.

So what do the colors mean? In light gray, it means they are banked, they have a good bank account, they can get access to financial services easily. In red means they’re underbanked. And in dark gray, it means they are unbanked or not banked at all. So if we look at Vietnam on the right, it has only 21% that are banked, 10% in red are underbanked, and 69% basically don’t have any bank accounts.

So this is both an opportunity and a challenge if you’re a tech startup.

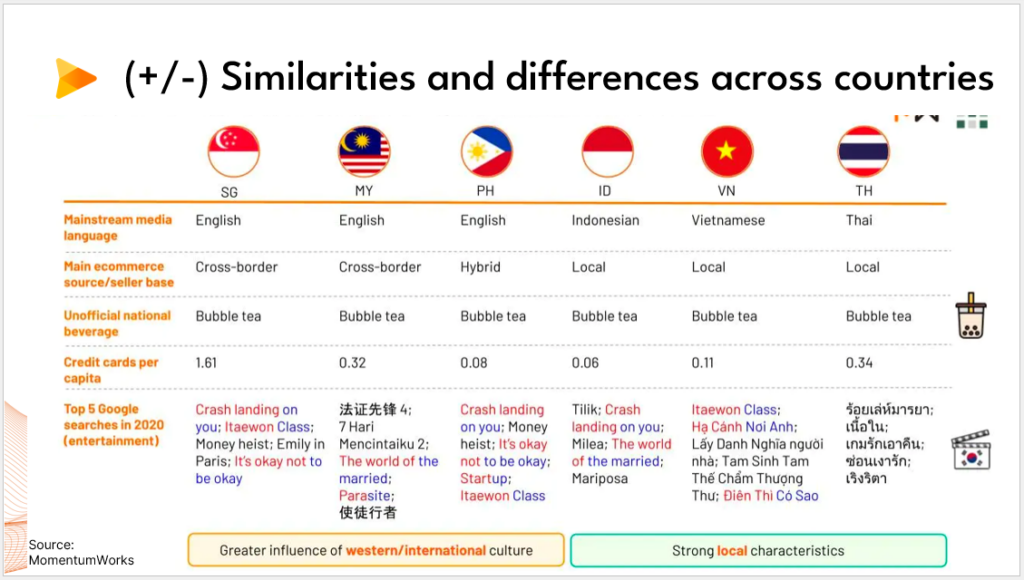

The other characteristic about Southeast Asia is that there are actually some similarities, but also many differences across all the six countries.

Let’s take language, for example, which is the first row. In Singapore, Malaysia and Philippines, English is spoken. But in Indonesia, Vietnam and Thailand, they speak only the local language.

But if you look at the third row, which is the sort of unofficial national favorite drink, bubble tea is the favorite drink for everyone across Southeast Asia.

On the other hand, if you look at credit card penetration, if you look at Singapore, which is highest, is 1.61, which means on average a person has 1.61 credit cards. But if you look at the lowest, which is Indonesia, it’s only point zero six, which means basically very few people have credit cards.

And what’s interesting in the last row is what are the top five Google searchers in entertainment. And you can see some similarities, which is some of the Korean dramas like Crash Landing on you, which is popular across many different countries. I don’t know why, but of course each country has its own specific preferences as well.

2. Tech Startups

Now let me talk about the tech startups in Southeast Asia.

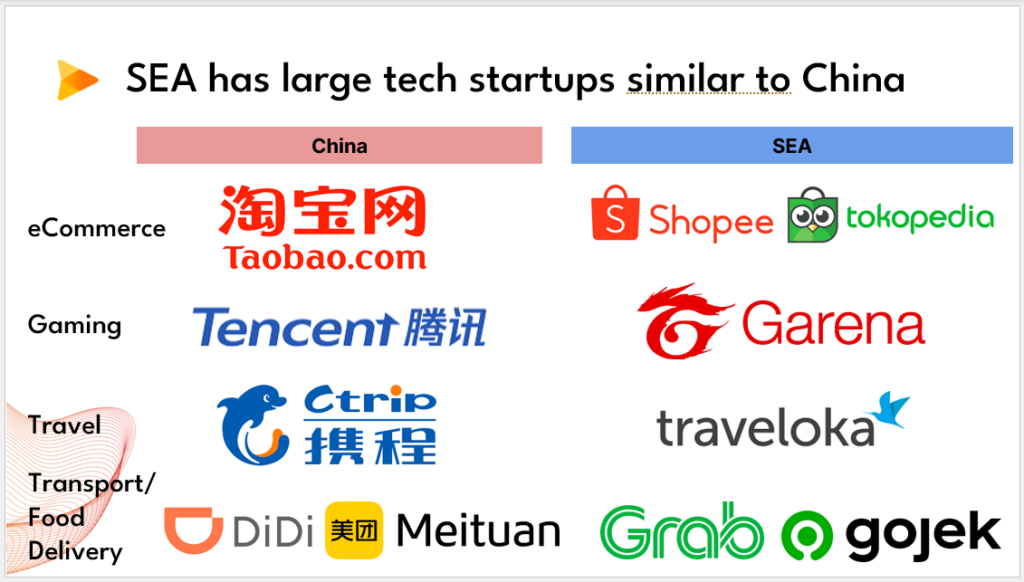

Southeast Asia has many large tech startups that’s similar to China. In China, for e-commerce, of course, there’s Taobao, and Southeast Asia, there’s Shopee and Tokopedia.

And for mobile or PC gaming, there is of course Tencent in China. And in Southeast Asia, there is a large startup called Garena, who’s also doing gaming.

And for online travel, there is Ctrip in China and in Southeast Asia, there is Traveloka.

and in a transport and food delivery of course in China,there is DiDi and Meituan, but in southeast Asia is Grab&Gojek.

And in Southeast Asia, there are now 54 unicorns, meaning a tech startup that has more than US$1 billion in valuation.

So lets talk about a case study, which is sea, sea for 海.

sea has three big companies. One is Garena, the second one is Shopee, and the third one is called seaMoney.

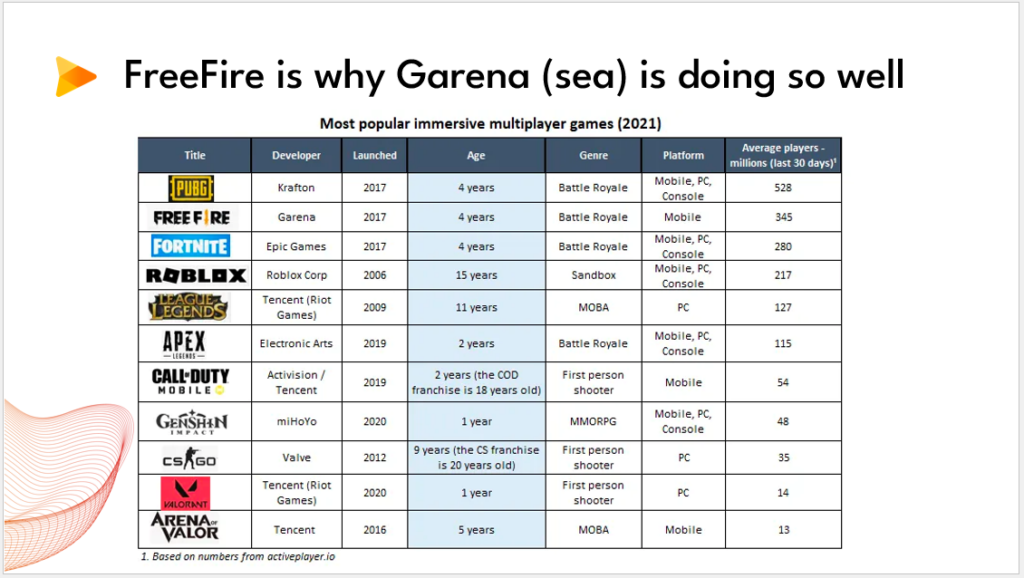

So sea started out with gaming, just like Tencent, and they grew big because they have one very big game of Free Fire.

So this chart shows the global ranking of games and can see that Free Fire is the second most popular game globally, and it continues to be quite popular even today.

Because of sea’s success in gaming, they next expanded to e-commerce. So this chart shows the top 10 most visited e-commerce websites in Southeast Asia.

As you can see, Shopee is the most popular by big margin. So, Shopee is a regional player across all six countries in Southeast Asia.

The next bigger player is Lazada. Lazada is also a regional player, and they are in all 6 countries in Southeast Asia.

The next two players, the one in green called Tokopedia, and the one in red called Bukalapak, those two are e commerce players that are only in Indonesia.

The last five or six companies, they are all also single country e-commerce players, either in Indonesia or Vietnam.

And the next thing after e-commerce that sea did was they expanded into financial services with seaMoney.

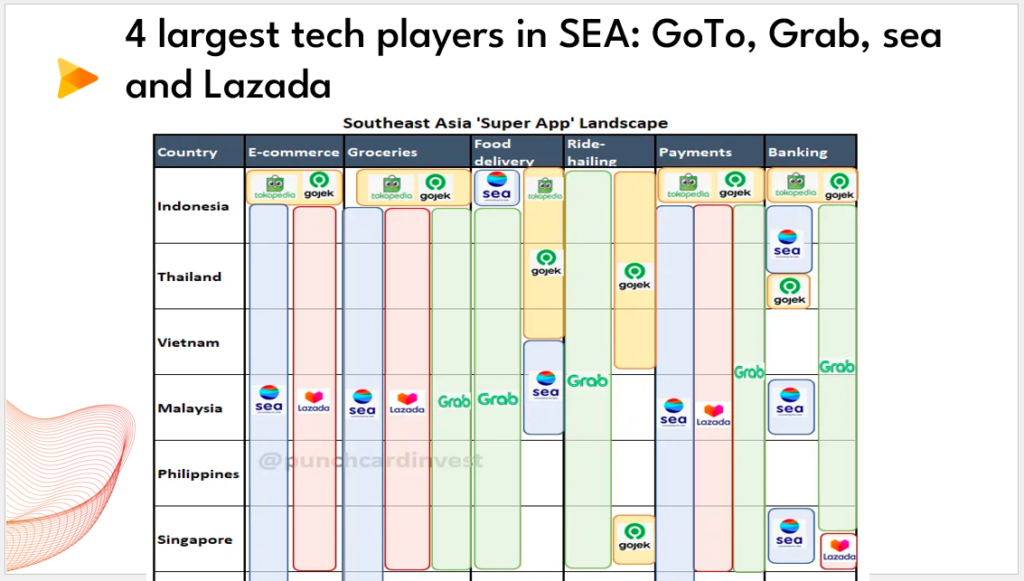

The reason they did that is because of what we talked about before, that there is so many underbanked and unbanked people in Southeast Asia. So just like in China, Southeast Asia also has different ecosystems forming across large tech players.

For example, in e-commerce, there is a Tokopedia Gojek ecosystem at the top, and there’s the sea ecosystem, which we just talked about. And there is a Lazada ecosystem also. And if you look at food delivery in the center, you have Grab, you have Gojek, and you also have sea, three different ecosystems. And on the right side, the last two columns, those are Financial Services. And that is where today all the ecosystems are fighting against each other for the financial services ecosystem.

3. Venture Capital

Now, let me talk a bit about venture capital trends.

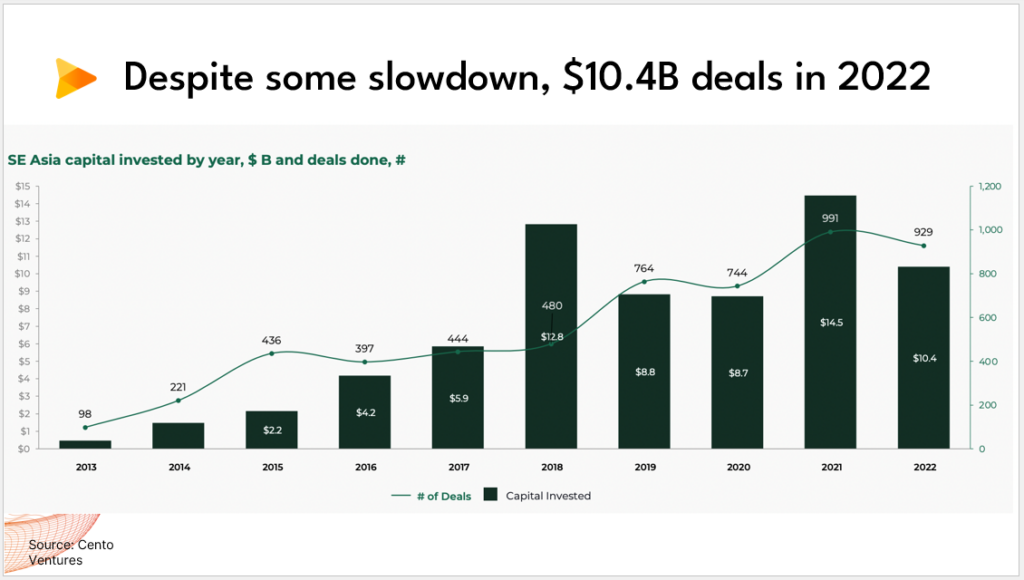

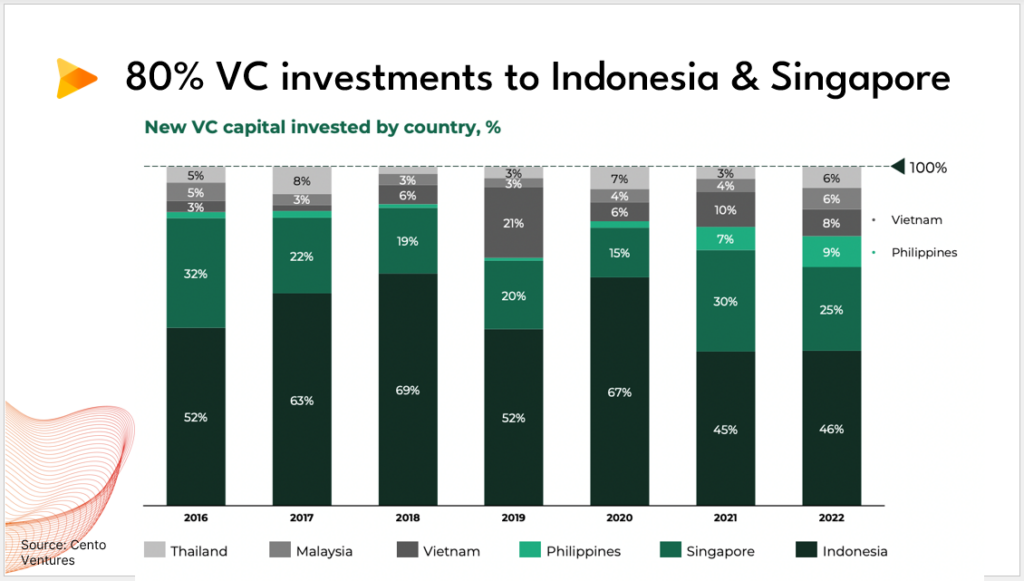

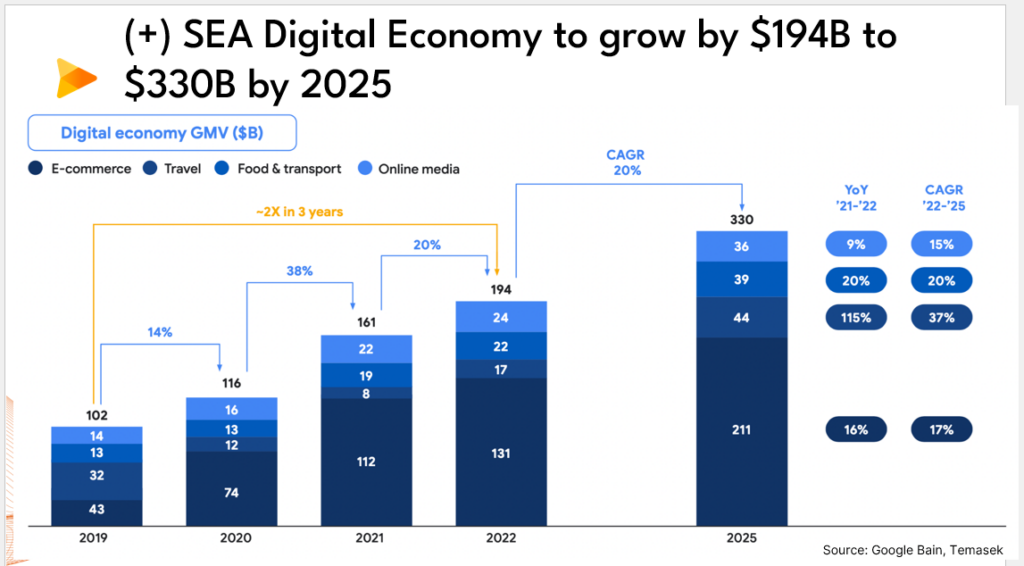

This chart shows in the dark green bars, the amount of capital invested in Southeast Asia, and the line shows the number of deals done every year. So we can see in 2022, there were about US$10.4 billion invested in venture capital coming from about 929 deals. So venture capital has been growing very strongly since 2013 to about 2021. And just like the global economy, there was a slowdown in 2022. And actually in the first half of this year, the performance is even worse than 2022.

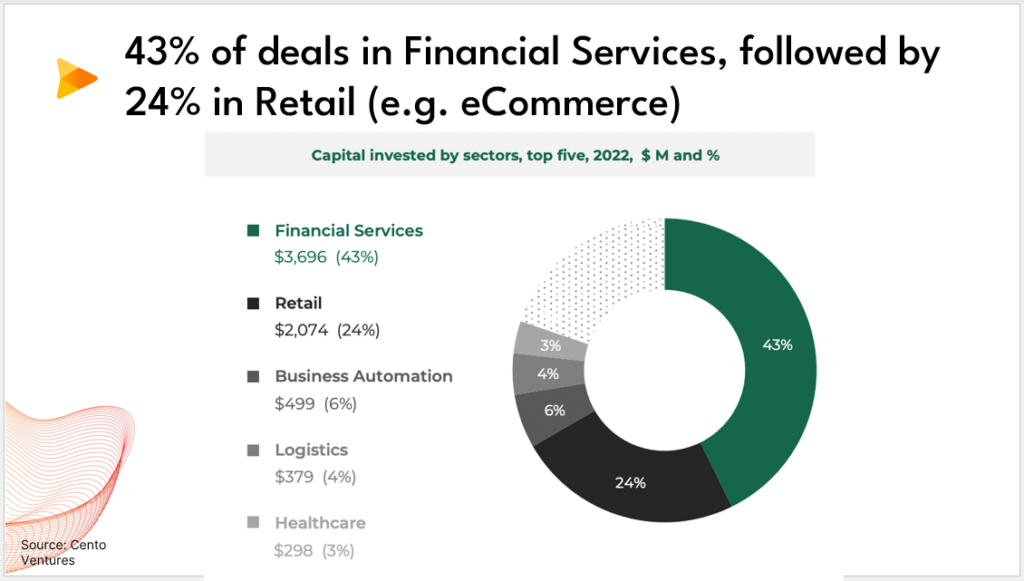

So where is the venture capital being invested in?

This chart shows the industry sectors that the VC money is going to. And the biggest proportion in green is financial services at 43%. And the next biggest sector is retail in black color, retail meaning, for example, e-commerce.

And now which country are the investments going to?

The dark green color is Indonesia, and the medium green color is Singapore. So you can see that over the years, most, about 80% of venture capital investments are always going into Indonesia and Singapore. And that’s why they are the most startups in both Indonesia and Singapore and Southeast Asia.

4. Personal Learnings

Now let me share a bit about my personal learnings about what it takes to succeed in a tech entrepreneurship and in venture capital.

The first concept that is very important is total addressable market, or how big the market opportunity is.

For example, in this image, you might think that, for example, e-commerce typically has a very big addressable market. That’s like the blue whale. But normally, online travel is actually much smaller, so that’s kind of like the elephant.

And of course, if you are a startup and you are operating in a very small market like the size of a diver, it is very difficult. So if you are, if you are entrepreneur and you are operating in a market which is very small, like the size of the diver, even if you’re the No. 1 player there, you’ll still be a very small company. So not only does a large market give the entrepreneur more room for growth, the other thing is that if you operate in a large market, it allows you more room to make mistakes.

So from the venture capital perspective, that is why what is the total addressable market is very important when venture capital capitalist think about whether to make an investment.

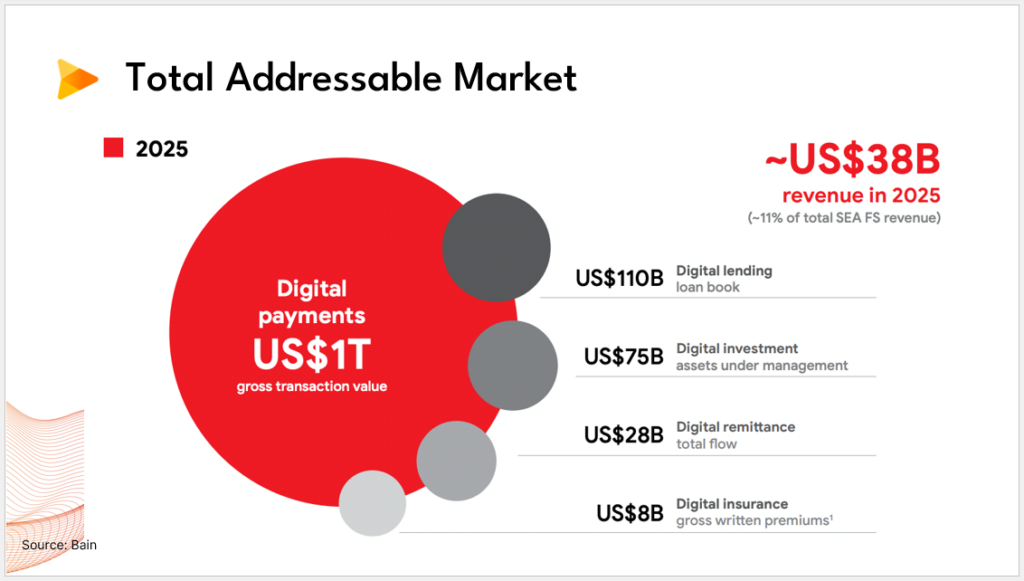

So applying this concept to financial services, for example, so this, the circles represent the addressable market for different financial services in Southeast Asia.

So the big red one is payments. The next biggest one in dark gray is lending, and the smallest circle at the bottom is insurance, and that is why today there are many startups in payments and also quite a lot of startups and lending, but only very few in insurance.

And the other aspect of scale is, this example of the event for Grabs’ drivers, I think, in Malaysia.

Grab has about 5 million drivers across Southeast Asia. And when it host events for its drivers, they have to rent very large football stadiums. And this is important for startups. Once they reach such a big scale, they always need to show how they are supporting the economies of each country that they operate in to get local government support.

The second important thing about being an entrepreneur is hard work. So it’s just like this person, you always feel like you’re pushing a stone uphill every single day.

So choosing to be an entrepreneur, to work in a startup is really a lifestyle choice. When I interview people who want to join my company, for example, I always look, always try to find out how hard are they willing to work. And they need to be aware that it is not easy.

The third thing is this quote is from Peter Drucker. And Peter Drucker is a famous management consultant who has written many books. So this quote is “Culture eats strategy for breakfast”, meaning that culture is more important than strategy.

And this is very true, because if you want to build, for example, a 5 or 10 year old startup to become a unicorn, you just need a good strategy. But if you want to build a 50 year old company or 100 year old company, it requires both good strategy and good culture. Because culture is the one that determines the continued execution of the strategy year after year. And strategy without execution is useless.

5. Looking Ahead

The last thing I wanted to share is some thoughts about the future of tech entrepreneurship in Southeast Asia.

So one way to understand what may happen in the future for Southeast Asia is to understand what has happened to similar regions in the past.

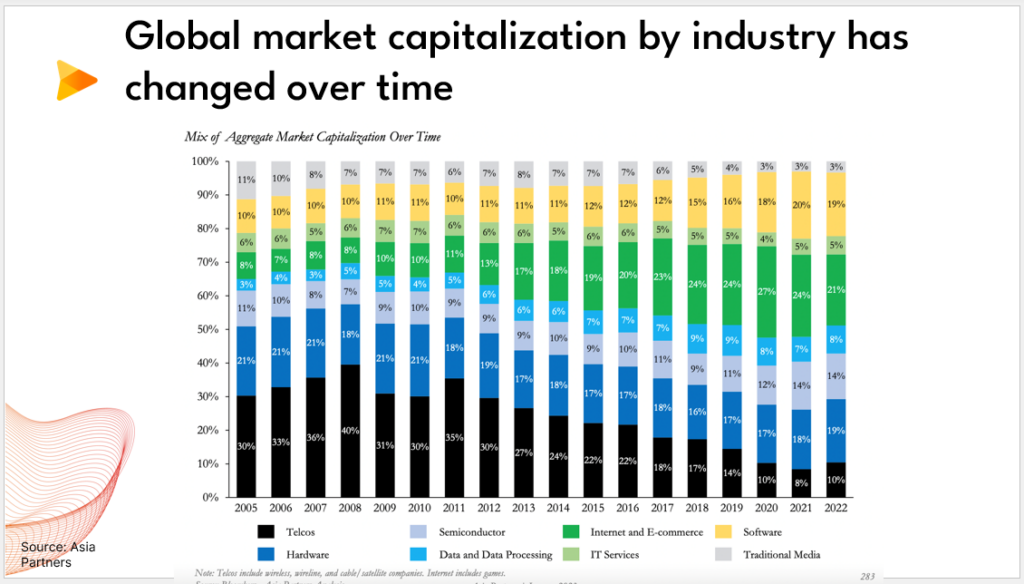

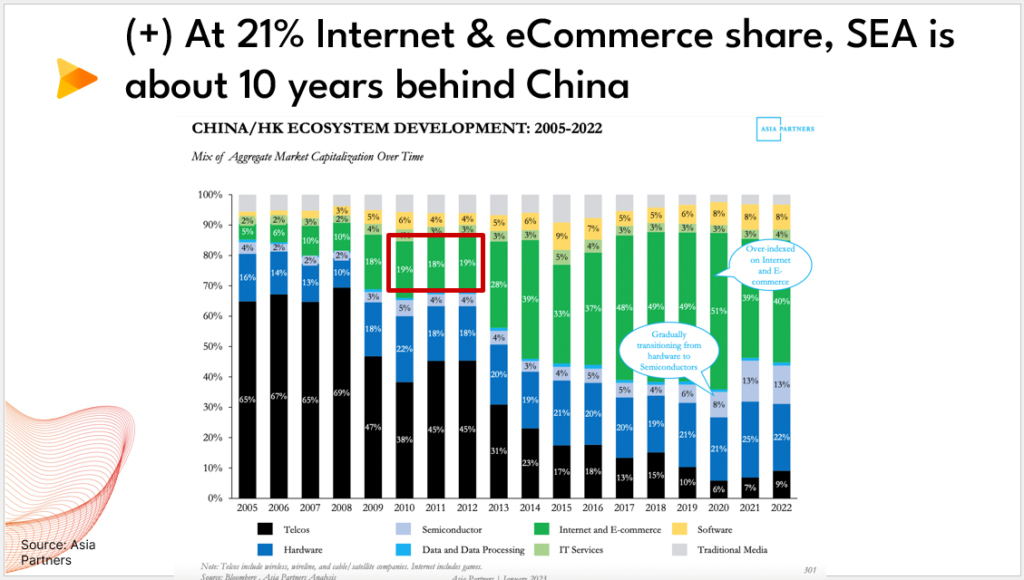

So, this chart shows the composition of market capitalization by different industries over time.

So in black is telcos, and in dark blue, it’s hardware. And the green one is internet and e commerce.

And we can see from this chart how in 2005, the market cap globally was dominated by telcos and hardware, the two parts in black and dark blue.

Internet and e-commerce was still very small at eight percent. And when we look at 2022, the green part has grown to 21%. but the black and down blue especially the black has decrease overtime.

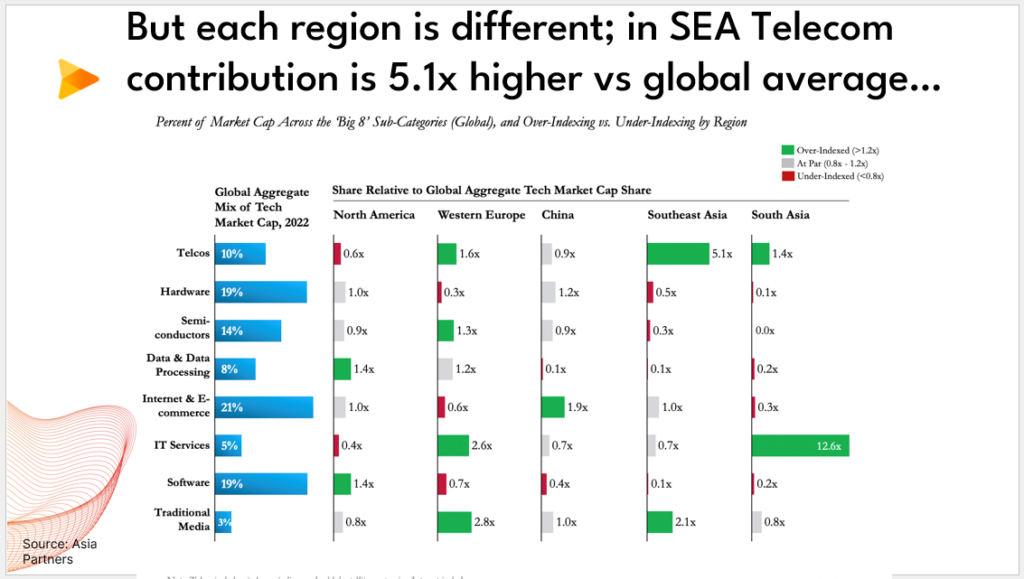

Of course that chart before was a global chart, but what is more important is what is the composition for each region?

Let’s focus on southeast Asia, which is the second column from the right. So in the first row at telcos, the global average that we saw just now for 2022 was about 10%. But if you look at Southeast Asia in 2022, the composition of telcos is 5.1 times higher then the global average. This means that in Southeast Asia today, a lot of the large companies on the stock market are still the telecom companies.

And conversely, if you look at the third row for semiconductors, globally the average is 14%, but in Southeast Asia, it is lower at 0.3 times of that. And that reflects the economy of Southeast Asia. There are very few semiconductor manufacturing facilities here, but each country has many large telecom or broad band players.

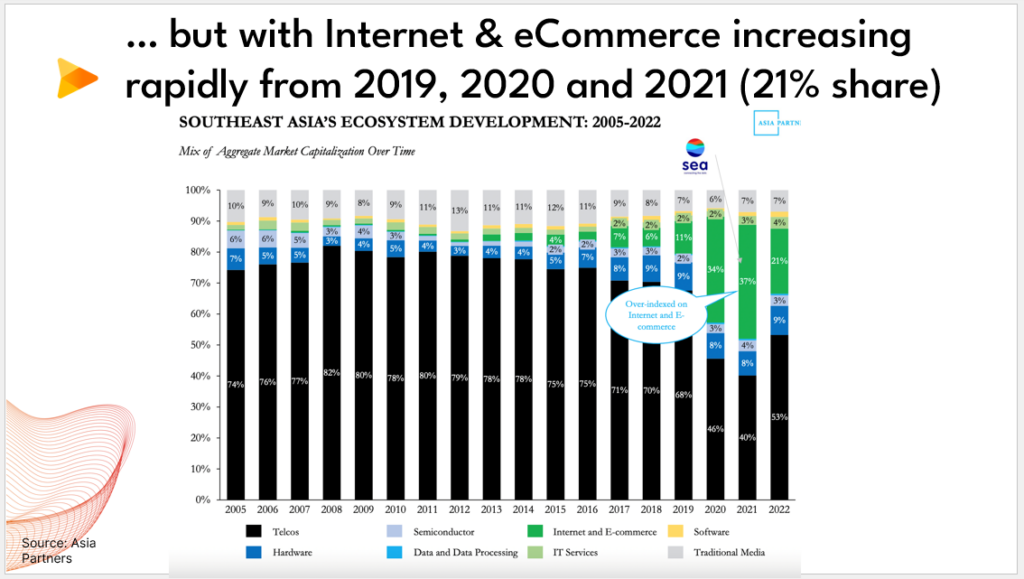

So let’s look at the same chart that we saw just now for Southeast Asia. So the same color coding, black is telecom and blue is hardware, and green is internet and e-commerce.

When we see that for many years, Southeast Asia was dominated by telecom companies until about 2020-2021, where there was a big increase in the green part, and that’s because of the market listing of sea. So today in 2022, internet and e-commerce takes up about 21% share of market capitalization.

Now let’s take a look at the chart, the same chart for China. so the color coding here is the same again, and let’s focus on the green part. I can see from 2010, 2011 and 2012 thats when the composition of internet e-commerce was about 19-20% for China.

And of course, recently in 2021 and 2022, that green part has grown even more, and is now about 40% of market capitalization. So in some sense, Southeast Asia’s economy in terms of the importance of internet and e-commerce is about 10 to 12 years behind China

But it also means that if there is opportunity for the internet and e-commerce companies here to grow even more and to, at least to increase the 20% we saw just now, to double that to 40% as well.

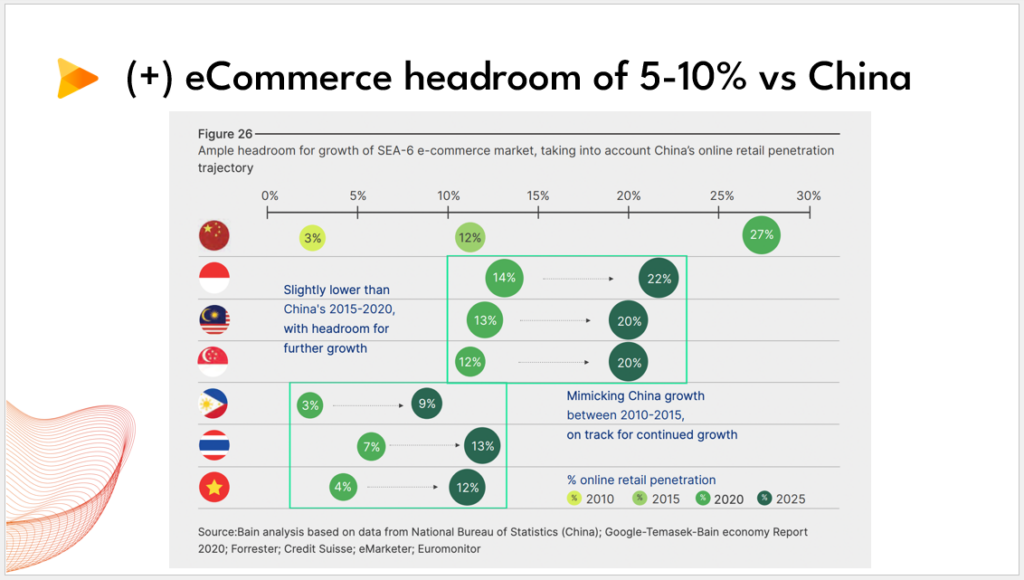

So let’s apply this thinking specifically for e-commerce. So the first row shows the e-commerce penetration for China over 3 years. The one in yellow is 3%, and that means that the e-commerce penetration in China was 3% in 2010, and that grew to 12% in 2015, and then grew to 27% penetration in 2020. So the e-commerce penetration for China in 2015 was about 12%.

Now let’s look at Southeast Asia. And the second role is Indonesia. So, Indonesia’s e commerce penetration was 14% in 2020. And you compare it with the last row, which is Vietnam. In Vietnam, the e-commerce penetration in 2020 was only 4%. So we can see that there is actually a lot of growth potential for the e-commerce penetration of each country. For example, in Indonesia, the projection is for e-commerce penetration, the growth from 14% in 2020 to 22% in 2025.

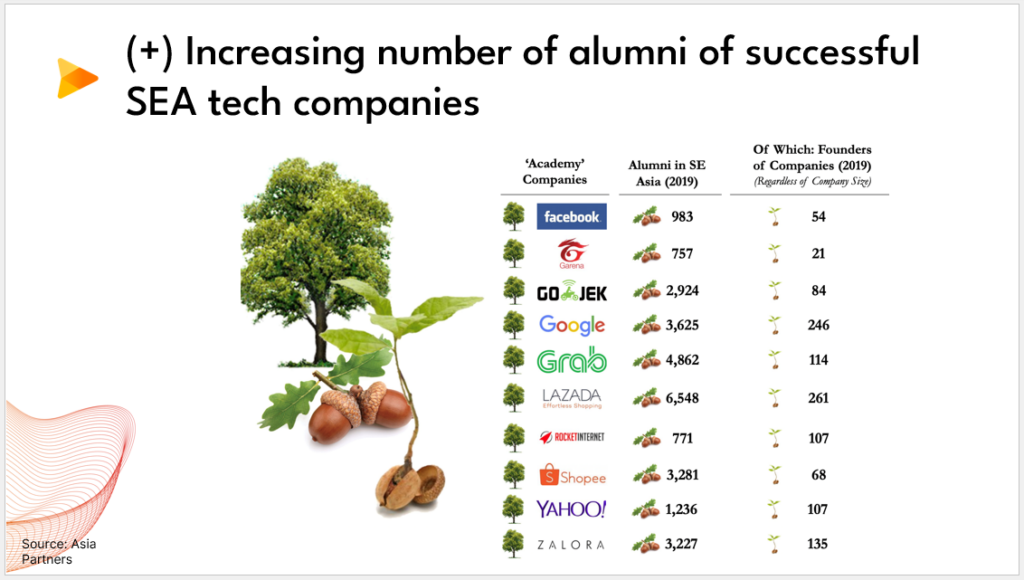

The other important factor is talent, or human talent.

So this table, the first column shows the original company of the employee. And the second column tells you how many ex-employees or alumni they have in Southeast Asia. And the third column tells you among those alumni, how many actually have started a new startup. Alumni, they have left the company. For example, Facebook. They have 983 alumni in Southeast Asia who have left Facebook. And all of the 983, 54 of them have started a new startup. I just want to make it clear the SEA here is not the company is Southeast Asia.

And the third column is founders of new startups. Just to repeat, in the first row, Facebook, there were 983 who left Facebook, 983 employees. And now of the 983, 54 of them started a new company.

The other example from somewhere in the middle of a table is Lazada. Lazada has the most alumni in Southeast Asia, 6548. And out of the 6548, they also produce the most new startups, 261.

And one more example is the last company at the bottom, Zalora, which is a fashion e-commerce. There are 3227 alumni and all of those 135 have become founder.

Now this is important because founders who have experience working in a larger, more successful tech company have a much higher chance of succeeding when they build their own startup. So a good example is the Zalora.

Zalora has many famous alumni who has started many different successful startups at the bottom. So all these startups at the bottom including Gojek, which is a very big unicorn today, and Shopee, another big company. All these were started by founders who previously work in Zalora. Zalora also started quite early in 2012. So they’re one of the earlier tech companies in Southeast Asia, so they can train so many goods entrepreneur, startup entrepreneurs.

And that is how the tech ecosystem keeps growing. All these new companies will, in turn, produce other new startups when their employees leave their company. And that’s why I am personally very optimistic about the digital economy of Southeast Asia. So it grew by two times in the past three years, from 2019 to 2022, and it’s expected to keep growing further towards 2025.

And this is actually what I wanted to share with you today. I hope that it was useful that everyone managed to learn something from today. Thank you very much.

6. Q & A

Q: What’s the opportunity trend for tech startup that could be in China?

A: I’m probably not the expert on China, but what I would say is that I think if I were a tech startup or a tech company in China, there are always opportunities. I think first of all, if I were already establish company in China, especially if I’m doing software, I think there’s always very good opportunity to expand to other countries geographically, especially for software business, geographical expansion is tends to be easier.

The other type of opportunity I’ll look for is sort of doing the same analysis for China as what I did for Southeast Asia. So if you look at internet, ecom and digital economies, which are more advanced in China, which aren’t a lot, but maybe you can look at, for example, how the US internet and digital economy has progressed despite some of the slowdown. And the few sectors that still doing very well, of course, one is actually hardware and Semicon, and that’s because that’s driven by the demand from AI. So that could be one opportunity, for example, basically for hardware, for chips for AI.

Q: Is there any experience or use cases for blockchain in Singapore?

A: In Singapore there are two main use cases for blockchain so far. One is the use for blockchain itself, a web tree technology to facilitate B2B Trade. So to conduct B2B trade, because for B2B trade, it used to be done on many different systems. So with blockchain technology, you can consolidate all of that into a single Ledger system. So that’s use case number one.

The second use case, which is still quite new of course, is the use of a stable coin. So there’s many pilots on stable coin going now, but one of the primary use cases for stable coin will also be for cross border remittance. So that’s a 2 c use case, cross border to see remittance using stable coin.

Q: Any opportunity for building factories in Southeast Asia? Some said Chinese factories are moving to Southeast Asia, South America, India, and Africa.

A: The answer is definitely yes. As we could see from my presentation, there’s still a lot of growth opportunities in Southeast Asia. But you need to be aware of the differences between each country as we share just now.

Q: Cambodia was not mentioned just now. What do you think about Cambodia?

A: Cambodia is not in there, not because it is growing slowly. Cambodia actually is also growing very fast. But Cambodia is a much smaller country than Malaysia, for example. So that’s why it was not included.

Q: How many startup companies in Indonesia are from other regions and what are the trends?

A: Most of the startups who are coming from other countries tend to be from the rest of Southeast Asia as the most No. 1 source. Then in terms of the other countries, it will be from India. There’s a lot of Chinese startups as well, and then a few European. So mostly Southeast Asia, the rest of Southeast Asia, India and China. The trend is very mixed.

Q: What are the opportunities and challenges for Chinese manufacturing industry moving to southeastern countries?

A: I think there have been quite a few examples already in Thailand, Vietnam and Indonesia, especially, so a lot of Chinese manufacturing companies have set up there. But again, what is important to know is that every country has different regulations for each industry. So for some countries, maybe a specific industry is more protected. And if that’s the case, then you do need to look for a local partner to set up the company.

Q: Currently I’m working in a venture capital company and we mainly invest in high tech. Do I need to work for a while in the semiconductor company to gain more experience in high tech industry, so that I can work back better in venture capital industry?

A: I think actually it’s not necessary. So I’ve seen many successful venture capitalist who just stay as an investor for their whole career, and they are very successful. And naturally as you get more senior, you will also tend to focus naturally on specific industries. And that’s where you get the industry knowledge from. So I don’t think it’s necessary to work in that industry that you wanna focus on.

Q: Which SEA countries have regulations suitable for cross border e-commerce?

A: I think of course Indonesia specifically if anyone follows a news recently, Indonesia has become more strict and protectionist for e-commerce especially. So they may put in some regulations to sort of restrict cross border e commerce. So normally each country has different levels of Protection for their local economies. So Indonesia is quite protectionist and Vietnam is also quite protectionist in general. So this question would then really depends on the local regulations. Conversely, Singapore and Malaysia tend to be a bit more open for cross border trade and e commerce.

Q: Food delivery is popular now in Thailand. How is the challenge to manage the team there? People are more casual.

A: Actually the people are more casual compared to China in many countries in Southeast Asia. So that’s why I think when anybody wants to expand to a new country or business or start a new business in our country, you need to understand how the locals work and how do you manage them so that you can get the best performance out of them but make them feel appreciated and happy as well. So this goes back to understanding the local culture of each country and trying to adapt to it.

Note: The positions involved in the article only represent the personal views of the guests and do not represent the positions and opinions of the college.

- DOKU CEO

- 美国西北大学凯洛格商学院MBA

- 伦敦大学金融硕士

- 加州大学伯克利分校工程理学和经济学双学士学位

- 曾担任 GrabPay、Grab 风险投资和集团战略的董事总经理

- 曾在PayPal、波士顿咨询集团、亚瑟D.利特尔和新加坡航空公司多家大公司担任区域领导职位

- Digital Mission Venture 联合 创始人(该机构主要做为东南亚地区科技初创公司的加速器和投资人)